There are many myths about credit scores circulating online, which can confuse people trying to improve their scores. Those unfamiliar with the actual algorithms lenders use often believe these myths to be true.

Understanding the various algorithms behind credit scores is key to knowing your actual score. Often, we pay for credit scores without realizing there are different types, which can lead to confusion and reinforce common myths.

Myths

- Paying out for auto loans easily helps my credit score

- Checking credit reports decreases the credit score.

- Free credit reports are always true

- Paying collection raises my credit score

- Giving access to the card

- You are using your credit card monthly

- Inquiries affect the credit score

Myth #1: Paying off auto loans quickly will improve my credit score

One of the common myths about credit scores is that paying off auto loans early can help increase your credit score. Those unfamiliar with the factors that affect the credit score will believe this to be true.

Early auto loan payoff impacts on three factors of the FICO score algorithm:

- Payment history

- Credit mix

- Average age of open accounts

Payment history

Payment history accounts for 35% of your FICO score and helps lenders assess how responsible you are with debt payments. A long history of timely payments significantly improves your credit score.

However, paying off loans early can actually shorten your payment history. This results in a thin credit file, making it difficult for lenders to evaluate your payment behavior. A short payment history may negatively impact future loan approvals, as closed accounts reduce the length of your credit history.

Since payment history is the largest factor affecting your credit score, keeping accounts open and maintaining a long, positive payment record is key to building a strong credit profile.

Credit mix

The credit mix, which includes information about loans, mortgages, and other types of credit, accounts for 10% of your total credit score. While it may seem like a small percentage, even minor factors can significantly impact your overall credit score.

Paying off an auto loan early may remove it from your credit mix, which can lower your credit score in the future. This removal reduces the diversity of your credit profile, making you appear less creditworthy to lenders and potentially harming your ability to secure loans.

What Is Credit Mix and Why Is It Important?

Credit mix refers to the variety of credit accounts you have, such as credit cards, mortgages, auto loans, personal loans, and other lines of credit. Lenders like to see that you can responsibly manage different types of debt. This factor impacts 10% of your FICO score.

While 10% may seem small, a diverse credit mix can show lenders that you’re able to handle different types of credit responsibly, which can enhance your creditworthiness. Conversely, having only one type of credit or paying off certain accounts too early may reduce the diversity in your credit profile and lower your credit score.

How Credit Mix Affects Your Credit Score

Why Credit Mix Isn’t Just for Big Loans: Even if you don’t have a mortgage or auto loan, managing smaller credit lines like store credit cards or personal loans can contribute to a healthy credit mix. Regular payments on a variety of accounts show lenders that you’re capable of handling multiple financial responsibilities.

Diversity Matters: A mix of installment loans (like auto loans and mortgages) and revolving credit (like credit cards) is considered ideal. Having both types of credit indicates to lenders that you can manage different financial obligations responsibly.

Removing Credit Accounts: Paying off an account, like an auto loan, early can reduce the diversity of your credit mix. When that account is closed and removed from your credit report, it could negatively impact your score because it diminishes the range of credit types you’ve successfully managed.

Myth #2: Checking your credit decreases your credit score

A widespread myth is that checking your credit report will harm your credit score, but this is not true. When you check your own credit report, it results in a soft inquiry (also called a soft pull), which does not impact your credit score. Soft inquiries occur when you or a third party, such as a potential employer, checks your credit for informational purposes, and these inquiries are harmless to your score.

On the other hand, hard inquiries occur when a lender or financial institution checks your credit in response to a credit application (for example, when applying for a loan, mortgage, or credit card). While a hard inquiry can lower your score by a few points, checking your own report is always safe and has no effect.

In fact, regularly checking your credit report is a smart practice. It allows you to:

- Monitor for Errors: Catch and dispute any inaccuracies that could be dragging down your score.

- Spot Fraudulent Activity: Keep an eye out for signs of identity theft or unauthorized accounts.

- Track Your Progress: See how your credit score improves over time as you pay down debt or establish positive payment history.

It’s important to know the difference between soft and hard inquiries, as this misconception often discourages people from regularly reviewing their reports. Monitoring your credit frequently through free services or credit bureaus won’t hurt your score—it can actually help you maintain a healthier financial profile.

Myth #3: Free Credit Reports Are Always Accurate

One more thing I want to add here is that the credit score you get from the free credit report website is not always the same version your lender is using to qualify you for a loan. Experian, Transunion and Equifax are the only two major bureaus that can check your Fico credit score.

Another misconception is that the credit scores provided by free credit report websites are always accurate and reflect the same score that lenders see. However, this isn’t entirely true. While you can obtain free credit reports, the credit score you receive might not be the same as the one lenders use.

The three major credit bureaus—Experian, Equifax, and TransUnion—are the official agencies that provide credit reports, but only Experian and Equifax offer the widely used FICO credit score. The FICO score is the most trusted scoring model used by 90% of lenders to evaluate creditworthiness.

Websites like CreditKarma and other free services often provide a VantageScore instead of a FICO score. While VantageScore can give you a general idea of your credit health, it’s not used by most lenders, as it calculates scores differently. For example, VantageScore gives less weight to factors like payment history and can result in a credit score that’s either higher or lower than your actual FICO score. This discrepancy may mislead you if you’re preparing for a major financial decision, such as applying for a mortgage or a car loan.

Additionally, free credit report services—like the one provided by AnnualCreditReport.com—allow you to download your credit report, but they do not include your credit score. To access your true FICO score, you often need to purchase it from the bureaus directly or use a service that offers FICO scores specifically.

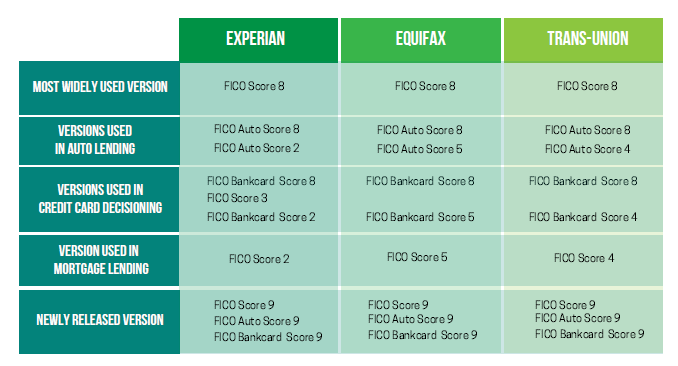

FICO Score Versions

There are multiple versions of the FICO score—in fact, there are sixteen different versions. Lenders may use FICO Score 2, FICO Score 4, or FICO Score 5, depending on their industry and what type of loan you’re applying for. It’s important to know which version a company or lender is using to ensure you understand what your actual score is in their eyes.

In summary, while free credit reports can help you monitor your credit, it’s essential to know which score you’re receiving and how it differs from the FICO score most lenders use. Always double-check with the major bureaus or use services that specifically offer FICO scores to get a more accurate understanding of your credit standing.

Credit report information security

These free sources provide you with a vantage point that will not help you with your credit card. On the other hand, they will record all the information about the credit report of the specific person. In this way, they sell this information to the new credit card companies.

The credit card companies started to advertise their products to such customers to sell their products. Because Credit Karma has a lot of information, the customer conversion rate from the information it provides is very high.

Myth #4: Paying Off Collections Instantly Raises Your Credit Score

Many people believe that paying off a collection account will immediately boost their credit score, but this is a myth. While settling a collection debt is generally a good financial move, it doesn’t always have the positive impact on your credit score that you might expect.

The effect of paying off collections depends on several factors, including the type of debt and how the collection is reported. Even after the debt is paid, the collection account can remain on your credit report for up to 7 years from the date of the original delinquency. During that time, it may continue to impact your score, regardless of whether it’s marked as “paid.”

Why Doesn’t Paying Off Collections Always Help?

- Impact on Credit Score: Once an account goes to collections, the damage is already done to your credit score. Paying it off doesn’t remove the negative entry; it only updates the status to “paid,” which doesn’t have the same positive impact as other credit behaviors like timely payments.

- Debt Type Matters: Some debts, like medical bills, may be treated differently by certain credit scoring models. For example, newer versions of the FICO score ignore paid medical collections, so settling these could improve your score. However, older versions of FICO or different models, like VantageScore, may still factor in paid collections.

- Collections Stay on Your Report: Even though you’ve paid off the debt, collection accounts remain on your credit report for up to 7 years. This means lenders will still see that you had a delinquent account, and it could still affect their lending decisions. Paying the debt does not automatically remove the collection from your report unless you negotiate a “pay for delete” arrangement with the creditor.

The Least Regulated Section of Credit Reports

Debt collections are one of the least regulated areas in credit reporting. While some creditors are diligent about updating the status of paid collections, others may not be as proactive in removing or updating these accounts. It’s up to you to monitor your report and, in some cases, request that the creditor or collection agency removes the collection from your file once the debt is settled. However, this is not guaranteed, and the removal is often at the creditor’s discretion.

In summary, while paying off collections is a responsible step, it may not result in the immediate credit score improvement many people expect. It’s essential to understand how different types of debt and collection reporting affect your credit, and be prepared for the possibility that old collections could remain on your report for several years.

Pay Off Debts Properly to Protect Your Credit

It’s important to understand how paying off debt can impact your credit report. Contrary to popular belief, closed accounts (loans or credit lines that have been paid off) generally have no immediate positive effect on your credit score. However, if you’ve settled a debt in full, you can notify the credit bureaus in writing, requesting them to update your credit report to reflect the payment. While this won’t remove the account from your report, it will show as “paid,” which can be beneficial when lenders review your credit history.

In some cases, it may still be advisable to pay off remaining debts, even if the immediate credit score impact is minimal. Hiring a credit specialist can be a wise move here, as they can navigate the complex legal frameworks that support consumers, including laws and regulations designed to protect credit card holders.

Ask for Debt Validation

Another crucial step in improving your credit profile is to request validation of any outstanding debts. You can send a validation request to the credit company or collection agency, requiring them to provide proof of the debt’s legitimacy. This is an important tool for consumers because if the creditor cannot validate the debt, it must be removed from your credit report.

However, keep in mind that medical debt validation often follows different rules. Medical debts are treated differently under federal law, and validation processes may be more complex. In cases of weak regulation, you may need to take legal steps to challenge or validate medical debts.

How a Credit Specialist Can Help

Hiring a credit specialist can simplify this entire process. A specialist can help you:

- Avoid harassing calls from creditors or debt collectors.

- Request proper validation of any debts that are incorrectly listed on your credit report.

- Legally dispute any debts that have already been paid off or that are unverifiable.

By taking these steps, you can remove unverified or invalid debts from your credit report, which helps protect your credit score from unnecessary damage.

Myth #5: Giving a Collection Company Access to Your Credit Card for Payments Is Safe

Sometimes, people provide their credit card information directly to collection companies to make automatic payments easier, allowing the company to deduct payments automatically. While this may seem like a convenient way to save time, it also grants the company permission to deduct any remaining balances or fees from your card at any time.

This practice can potentially lead to unexpected charges, especially if the company deducts more than anticipated or if there are disputes over remaining balances. Additionally, automatic access to your card means you have less control over when and how payments are made, which can sometimes result in overdraft fees or higher-than-expected charges.

How to Protect Yourself:

- Set Up Manual Payments: Instead of giving direct access to your card, consider manually scheduling your payments each month.

- Monitor Your Statements: Regularly review your credit card statements to ensure that no unauthorized charges have been made.

- Limit Autopay Access: If you must use autopay, set clear limits on the amount that can be deducted to avoid unexpected large withdrawals.

In summary, while automatic payments can save time, giving companies unrestricted access to your card can expose you to unexpected financial risks. It’s essential to maintain control over your payment methods and monitor transactions closely.

Myth #6: You can ignore credit cards when building credit

The Importance of Keeping Your Credit Card Active

Many people assume that once they open a credit card account, it will remain active indefinitely. However, if you don’t use your credit card for an extended period, it can become inactive or even be closed by the issuer. This can negatively impact your credit score in several ways, including reducing your available credit and potentially increasing your credit utilization ratio.

Why Keeping a Credit Card Active Matters

- Prevents Account Closure: Credit card companies regularly monitor account activity, and if they see long periods of inactivity, they may choose to close your account. This is particularly common with unsecured credit cards. When an account is closed, it decreases your total available credit, which can increase your credit utilization ratio—a key factor in determining your credit score. The higher your utilization, the more your score may be impacted.

- Maintains Credit History: Your credit history makes up 15% of your total credit score. If an account is closed due to inactivity, it may no longer contribute positively to the length of your credit history. Having long-standing, active accounts is beneficial because it shows lenders that you can manage credit responsibly over time.

- Boosts Credit Mix: A healthy credit mix (the variety of credit accounts, such as loans and credit cards) contributes 10% to your credit score. If your credit card becomes inactive or is closed, you might lose the positive impact that a diverse credit mix can have on your score.

How to Keep Your Card Active

You don’t need to make large purchases or use your credit card daily to keep it active. Simply using it for small, recurring expenses is enough to keep your account open and in good standing. One easy way to ensure regular usage is to set up autopay for subscription services, like Netflix, Spotify, or even small monthly utility bills.

By putting something like your Netflix subscription on autopay, you ensure the card is used regularly without significantly increasing your credit utilization. You can then schedule automatic payments through your bank or credit card provider to pay off the balance in full each month, which avoids interest charges while keeping the card active.

Benefits of Using Credit Cards for Autopay:

Builds Payment History: Regularly paying off even small balances helps build a positive payment history, which is the most important factor in your credit score (accounting for 35% of it). Even though the purchases may be small, consistent on-time payments demonstrate responsible credit usage.ned on your credit portal, and it changes with time. Some people pay their payments because of the reporting, and this trick helps them save their credit score.

Consistency: Subscriptions are billed on a monthly basis, ensuring your card is used regularly enough to avoid inactivity.

Low Utilization: Subscriptions typically have a low monthly cost, which helps keep your credit utilization ratio well below the recommended 30% threshold.

Simplified Management: Once set up, autopay makes it easy to manage payments and avoid late fees, while also ensuring your credit card stays active without the need to make additional purchases.

Myth #7: Inquiries Always Hurt Your Credit Score

Many people believe that any type of credit inquiry will significantly impact their credit score, but that’s not entirely true. It’s important to understand the difference between soft and hard inquiries and how they affect your credit score.

Soft inquiries—such as checking your own credit score or when a potential employer looks at your credit—do not appear on your credit report and have no effect on your score. They are considered harmless and are not factored into the credit scoring algorithm.

Hard inquiries, on the other hand, occur when a lender or credit card company checks your credit report to assess your creditworthiness for a loan or new credit card. Hard inquiries do appear on your credit report, but they only account for 10% of your overall credit score. A single inquiry might drop your score by up to 5 points, but this impact is typically short-lived and fades over time.

How Long Do Inquiries Stay on Your Credit Report?

Hard inquiries stay on your credit report for two years, but their impact on your score diminishes long before that. After the initial drop, inquiries won’t have a lasting negative effect, and most will only affect your score for a few months.

Shopping Around for Loans

When shopping around for the best rates on auto loans or mortgages, you may notice several inquiries on your credit report. However, credit scoring models are designed to treat multiple inquiries for the same type of loan—within a 30-day window—as a single inquiry. This is known as the shopping period rule, and it’s intended to allow consumers to compare loan offers without being penalized for each inquiry.

For example, if you visit several car dealerships within 30 days and they all pull your credit report, those multiple inquiries will count as just one inquiry on your credit report. The reason for the multiple inquiries showing up is that dealerships often work with several financing companies, but credit scoring models consolidate them into one inquiry for scoring purposes.

So, while you might see multiple inquiries when you check your report, don’t worry—they won’t significantly damage your score, and you can focus on getting the best loan terms.

New Credit Card Inquiries

When applying for new credit cards, each application is treated as a separate hard inquiry. For instance, if you apply for two credit cards in the same month, your credit report will show two distinct inquiries. These inquiries could temporarily lower your score by a few points, but this isn’t something to panic about if you don’t apply for new credit frequently.

When applying for a new credit card, you may be required to submit a letter of explanation to the credit issuer, especially if you’re applying for multiple cards in a short time frame. This letter should explain your need for additional credit and demonstrate your ability to manage it responsibly, often by highlighting your income-to-debt ratio. Credit companies will review this information to determine whether extending more credit will benefit or harm your financial situation.

Debunking Myths About Inquiries

It’s essential to remember that hard inquiries, while part of the credit scoring algorithm, have a relatively minor impact on your score and only account for a small portion of it. As long as you manage your credit responsibly, inquiries will not significantly damage your score in the long term.

Incite strategies is one of the most trusted credit repair services in the United States. We have helped thousands of clients improve their credit scores, manage their credit reports, and achieve financial stability. If you have questions about your credit report or need help managing inquiries, feel free to book a book a free consultation.